ป้ายกำกับ: Financial Boost

Unlock Your Financial Potential: Tips for a Powerful Financial Boost in 2023

Have you ever felt like you’re constantly struggling to keep up with your finances? Do you wish you had more money to invest, save, or simply enjoy? You’re not alone! Many people feel overwhelmed by their finances. But don’t worry, there are simple steps you can take to create a Financial Boost and gain more control over your money.

This article will give you actionable tips and strategies to give your finances a much-needed boost in 2023. Whether you’re looking to pay off debt, build your savings, or simply manage your money more effectively, we’ll explore practical solutions that can help you achieve your goals.

Start with a Solid Foundation: Understanding Your Finances

Before you can boost your finances, you need to understand where you stand. This means taking a close look at your income and expenses. You can do this by:

1. Tracking Your Spending: Keeping a detailed record of your spending for a few weeks or even a month can reveal where your money is going. There are apps like Mint, Personal Capital, or even a simple spreadsheet to help you track.

2. Creating a Budget: A budget helps you plan how you’ll spend your money. It involves listing your income and expenses and allocating your money accordingly. This allows you to see where you can cut back and allocate funds to your goals.

3. Analyzing Your Debts: Make a list of all your debts, including the interest rates. Knowing how much you owe and the associated interest can help you prioritize repayment strategies.

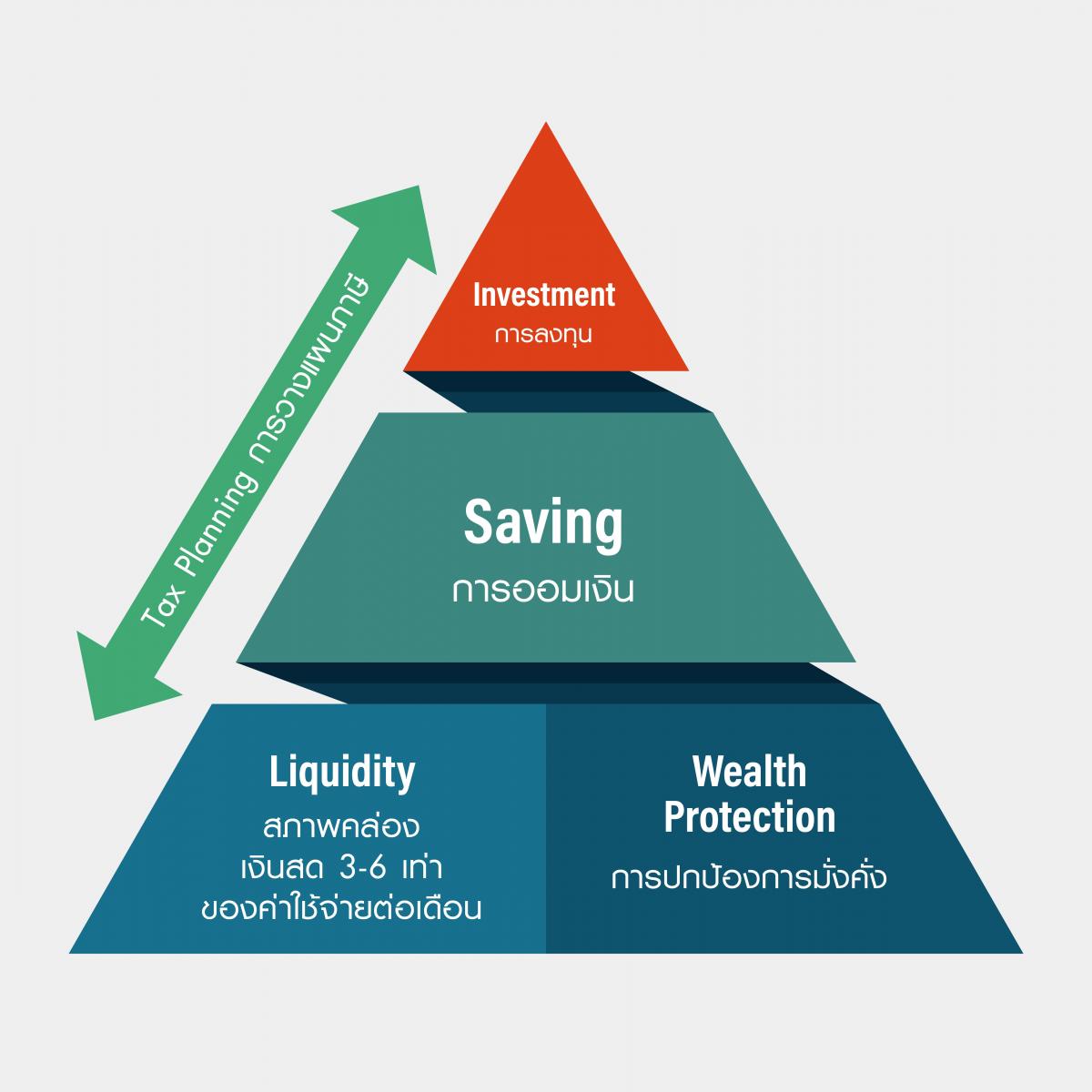

Boosting Your Savings: Building a Financial Cushion

Saving money is a vital part of a Financial Boost. Here are some ways you can boost your savings:

1. Automate Your Savings: Set up automatic transfers from your checking account to your savings account. This removes the temptation to spend the money and helps you save consistently.

2. Look for Ways to Cut Expenses: Analyze your spending patterns and identify areas where you can reduce costs. This could include cutting back on subscriptions, dining out less, or finding cheaper alternatives for everyday items.

3. Increase Your Income: Look for ways to earn extra income. This could include taking on a side hustle, selling unused items, or negotiating a salary increase.

Managing Debt: Breaking Free from Financial Burden

Debt can significantly impact your financial health. Here are some tips to reduce and manage your debt:

1. Create a Debt Repayment Plan: Prioritize your debts based on interest rates and focus on paying off those with the highest interest first.

2. Negotiate Lower Interest Rates: Contact your lenders and see if you can negotiate lower interest rates on your loans.

3. Consider Debt Consolidation: Combining multiple debts into a single loan with a lower interest rate can simplify repayment and potentially save you money.

Investing Your Money: Building Wealth Over Time

Investing can be a powerful way to grow your money over the long term. Here are some key points to consider:

1. Start Small: You don’t need a lot of money to start investing. Even a small amount can grow over time.

2. Invest Regularly: Regularly investing even small amounts can help you build wealth over time.

3. Seek Professional Advice: Consider consulting a financial advisor to get personalized investment advice.

Gaining Financial Freedom: Taking Control of Your Future

By following these tips and taking consistent action, you can achieve a Financial Boost and build a solid foundation for your future. Remember, it’s about making small changes and developing healthy financial habits that can lead to big results. Take it one step at a time, and you’ll be amazed at what you can accomplish.

Financial Freedom: This is not just about having money, but also about feeling confident and secure about your financial future. It’s about having the freedom to make choices that align with your values and goals.

Remember: Your Financial Boost is a journey, not a destination. Be patient, stay consistent, and you’ll be well on your way to achieving your financial goals.

Financial Boost, Financial Management, Personal Finance, Money Management, Saving Money