ป้ายกำกับ: Financial Guidance

Financial Guidance: Your Roadmap to a Secure Future

Imagine this: You’re a young adult, just starting your career, and you’re excited about building a bright future. But you’re also a little nervous about managing your money. You have dreams of a cozy apartment, fun adventures, and maybe even starting your own business someday. But how do you make those dreams a reality? That’s where financial guidance comes in.

Financial guidance is like a compass that helps you navigate the world of money. It’s about understanding how to make smart choices with your money so you can achieve your financial goals. It’s not just about saving; it’s about understanding your needs, planning for the future, and making decisions that will help you grow your wealth.

Understanding the Basics:

Before we dive into specific strategies, it’s important to understand some fundamental financial concepts.

- Budgeting: This is like creating a roadmap for your money. It helps you track where your money goes and makes sure you’re not spending more than you earn.

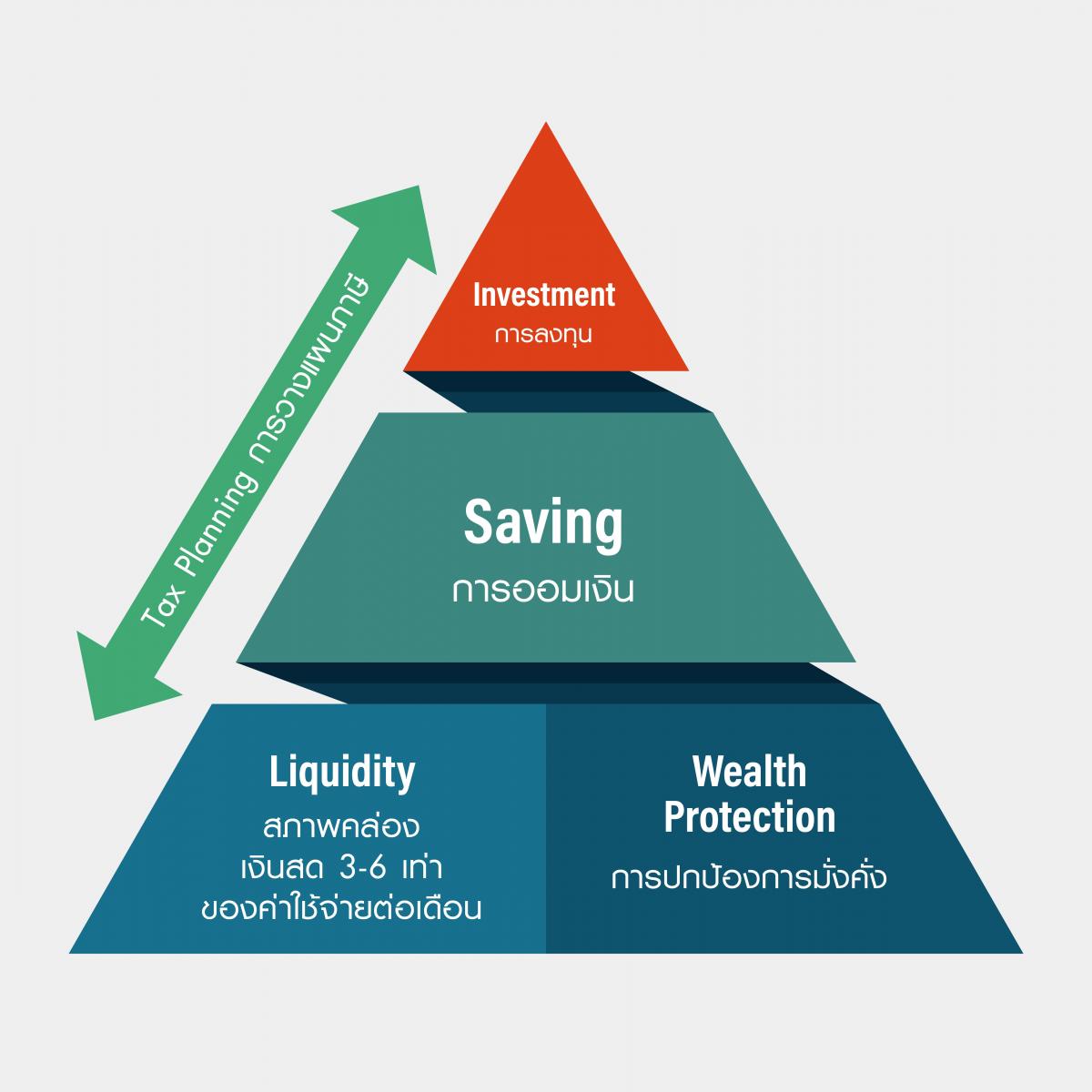

- Saving: Putting money aside for the future is essential. Saving helps you prepare for unexpected expenses, like medical bills, or for bigger dreams, like buying a house or taking a dream vacation.

- Investing: Investing is like planting a seed and watching it grow. You put your money into assets like stocks, bonds, or real estate, hoping they will increase in value over time.

- Debt Management: It’s important to understand how debt works and how to manage it responsibly. Too much debt can weigh you down financially.

Creating a Personalized Financial Plan:

There’s no one-size-fits-all approach to financial guidance. Your plan should be customized to your specific needs, goals, and risk tolerance. Here’s a step-by-step guide:

- Define Your Goals: What do you want to achieve with your money? Are you saving for a down payment on a house? Planning for retirement? Or simply trying to build a healthy emergency fund?

- Assess Your Current Financial Situation: Take stock of your income, expenses, assets (like your savings), and debts. This will give you a clear picture of where you stand financially.

- Create a Budget: Use a budgeting app or spreadsheet to track your income and expenses. This will help you identify areas where you can cut back and save more.

- Set Financial Goals: Break down your big financial goals into smaller, achievable milestones. This will keep you motivated and on track.

- Develop a Saving Strategy: Decide how much you can save each month and set up a system for regular saving.

- Consider Investing: If you have some money to spare after saving, you can explore different investment options.

- Review and Adjust: Financial guidance is an ongoing process. Review your plan regularly and make adjustments as your needs and circumstances change.

Seeking Professional Help:

If you find financial planning overwhelming, consider seeking professional help from a financial advisor. They can provide personalized guidance and support, helping you make informed decisions about your money.

Resources for Financial Guidance:

- Your Bank: Many banks offer financial planning services or access to educational resources.

- Credit Counseling Agencies: These agencies can help you manage debt and develop a financial plan.

- Government Websites: Websites like the Consumer Financial Protection Bureau (CFPB) provide valuable information on financial topics.

- Financial Literacy Websites: Websites like Investopedia and Khan Academy offer free financial education resources.

Remember, managing your finances effectively is an essential skill for achieving financial security and living a fulfilling life. Start your journey towards financial well-being today by taking the first steps towards creating a personalized financial plan.

Financial Planning, Financial Management, Budgeting Tips, Investment Advice, Debt Consolidation