ป้ายกำกับ: Financial Success

Unlocking Financial Success: A Guide to Building a Secure Future

Have you ever dreamt of having enough money to do whatever you want, without worrying about bills or making ends meet? Imagine being able to travel the world, buy your dream house, or simply have the freedom to pursue your passions without financial stress. This is the essence of financial success, and while it may seem like a distant goal, it’s achievable with a little bit of knowledge, planning, and consistent effort.

This guide is your starting point to learn about financial success and how to create a secure future for yourself. We’ll cover essential concepts and practical strategies to help you build wealth, manage your finances effectively, and achieve financial freedom.

What Does Financial Success Mean?

Financial success is about more than just having a lot of money. It’s about feeling secure and confident about your financial future. It’s about having the freedom to make choices and pursue your dreams without being restricted by money. It’s about achieving a balance between your income, expenses, and savings to create a comfortable and fulfilling life.

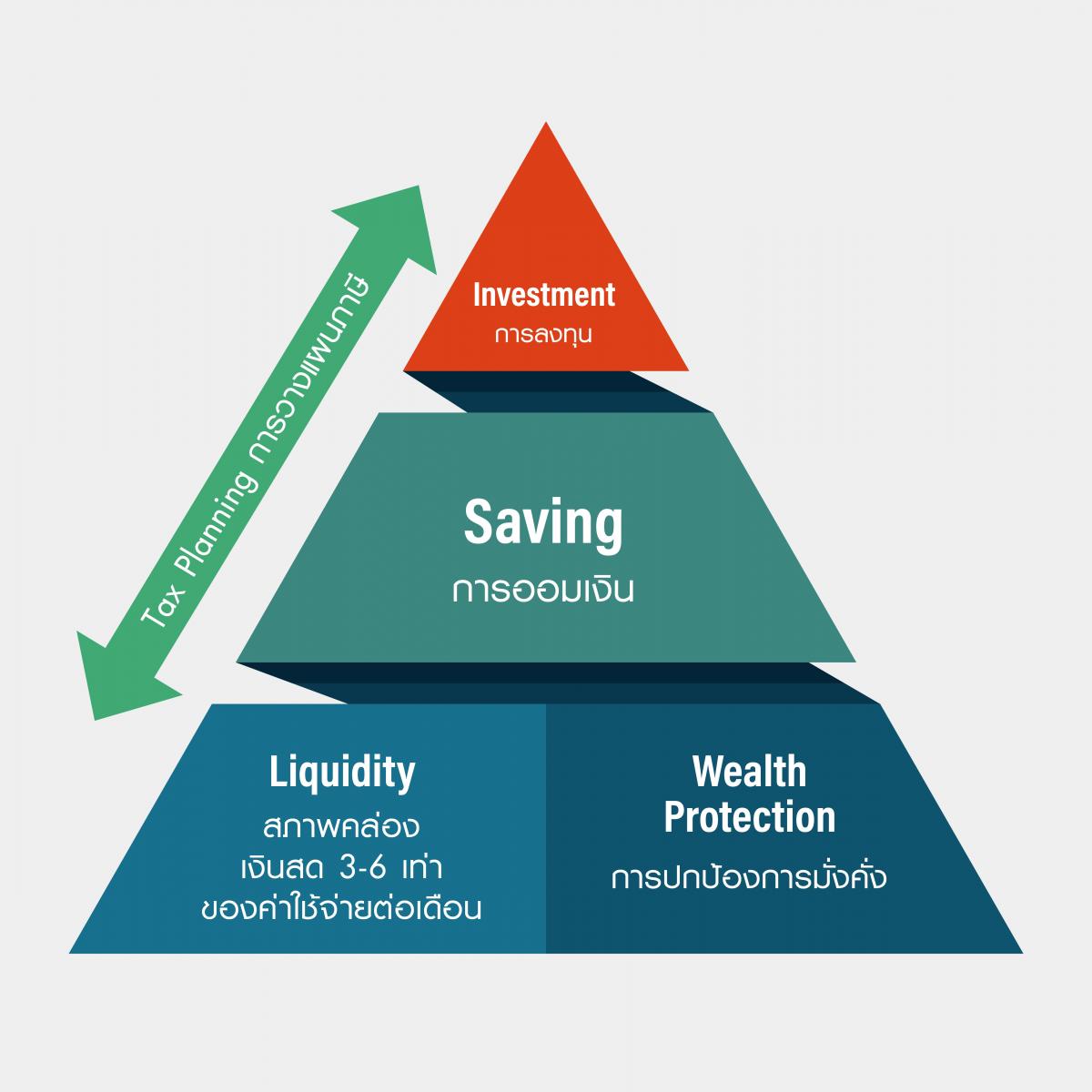

The Pillars of Financial Success

Building a strong foundation for financial success requires a multi-pronged approach. Here are some key pillars:

1. Budgeting and Financial Planning:

Creating a budget helps you understand where your money goes and enables you to make informed decisions about how to allocate your resources. It’s like having a roadmap for your finances, guiding you towards your financial goals.

2. Saving and Investing:

Saving is like building a financial safety net. It helps you prepare for unexpected expenses, emergencies, and future goals. Investing allows your money to grow over time, potentially leading to greater wealth in the long run.

3. Managing Debt:

High levels of debt can put a strain on your finances. It’s important to understand different types of debt, develop strategies for managing them effectively, and work towards reducing them over time.

4. Building a Strong Credit Score:

A good credit score opens doors to lower interest rates on loans, credit cards, and other financial products. Maintaining a good credit score is crucial for financial stability and access to affordable credit.

5. Income Generation:

Increasing your income can significantly impact your financial well-being. Exploring ways to boost your income, whether through a raise, a side hustle, or starting a business, is an important aspect of financial success.

6. Protecting Your Wealth:

Insurance plays a vital role in protecting your financial assets and mitigating potential risks. Having adequate insurance coverage for health, property, and other critical aspects of your life provides peace of mind and safeguards your wealth.

7. Financial Literacy:

Understanding financial concepts, markets, and investment options empowers you to make informed financial decisions. Continuously seeking knowledge and staying informed about financial trends is essential for navigating the financial world successfully.

Steps Towards Financial Success:

- Assess Your Current Situation: Take a close look at your income, expenses, debts, and savings. Identify areas where you can improve.

- Set Realistic Goals: Determine what financial success means to you. Set clear, specific, and achievable goals that motivate you.

- Create a Budget: Track your income and expenses. This allows you to identify areas where you can cut back and allocate more money towards savings and investments.

- Start Saving: Make saving a habit. Even small amounts add up over time. Consider automating savings by setting up regular transfers to your savings account.

- Explore Investment Options: Understand the different types of investments and choose options that align with your risk tolerance and financial goals.

- Manage Debt Wisely: Prioritize paying off high-interest debt. Develop a strategy to reduce your debt burden over time.

- Build Your Credit Score: Pay your bills on time, avoid excessive debt, and use credit responsibly to build a positive credit history.

- Continuously Learn and Improve: Stay informed about financial trends and seek knowledge about financial planning, investing, and wealth management.

Remember, financial success is a journey, not a destination. It’s about making consistent choices and taking consistent action towards achieving your goals. The key is to start now, learn from your experiences, and adapt your strategies as needed.

—

Financial Success, Financial Planning, Budgeting, Investing, Debt Management