ป้ายกำกับ: Wealth Enhancement

Unlocking the Secrets to Wealth Enhancement: A Step-by-Step Guide

Have you ever wondered how some people seem to effortlessly attract wealth while others struggle? Is there a secret formula for success, a hidden key to unlocking financial abundance? The truth is, while luck might play a small role, true wealth enhancement is the result of smart choices, strategic planning, and a consistent commitment to growth.

This article will guide you on a journey to understand the fundamental principles of wealth enhancement, empowering you to build a strong financial foundation and achieve your financial aspirations.

1. Define Your Financial Goals: What Does Wealth Mean to You?

Before embarking on any journey, it’s essential to know where you want to go. Similarly, before you start enhancing your wealth, you need to define what wealth means to you. Is it about financial freedom, early retirement, owning a dream home, or leaving a legacy for your loved ones?

Your definition of wealth will shape your financial goals. Once you know what you want, you can create a roadmap to get there.

2. Master Your Money Mindset: Think Like a Wealth Builder

Our beliefs about money significantly influence our financial behavior. If you believe that money is scarce, you’re more likely to hold onto it tightly, limiting your opportunities for growth. But if you believe in abundance and see money as a tool for creating positive change, you’ll be more open to taking risks, investing wisely, and building wealth over time.

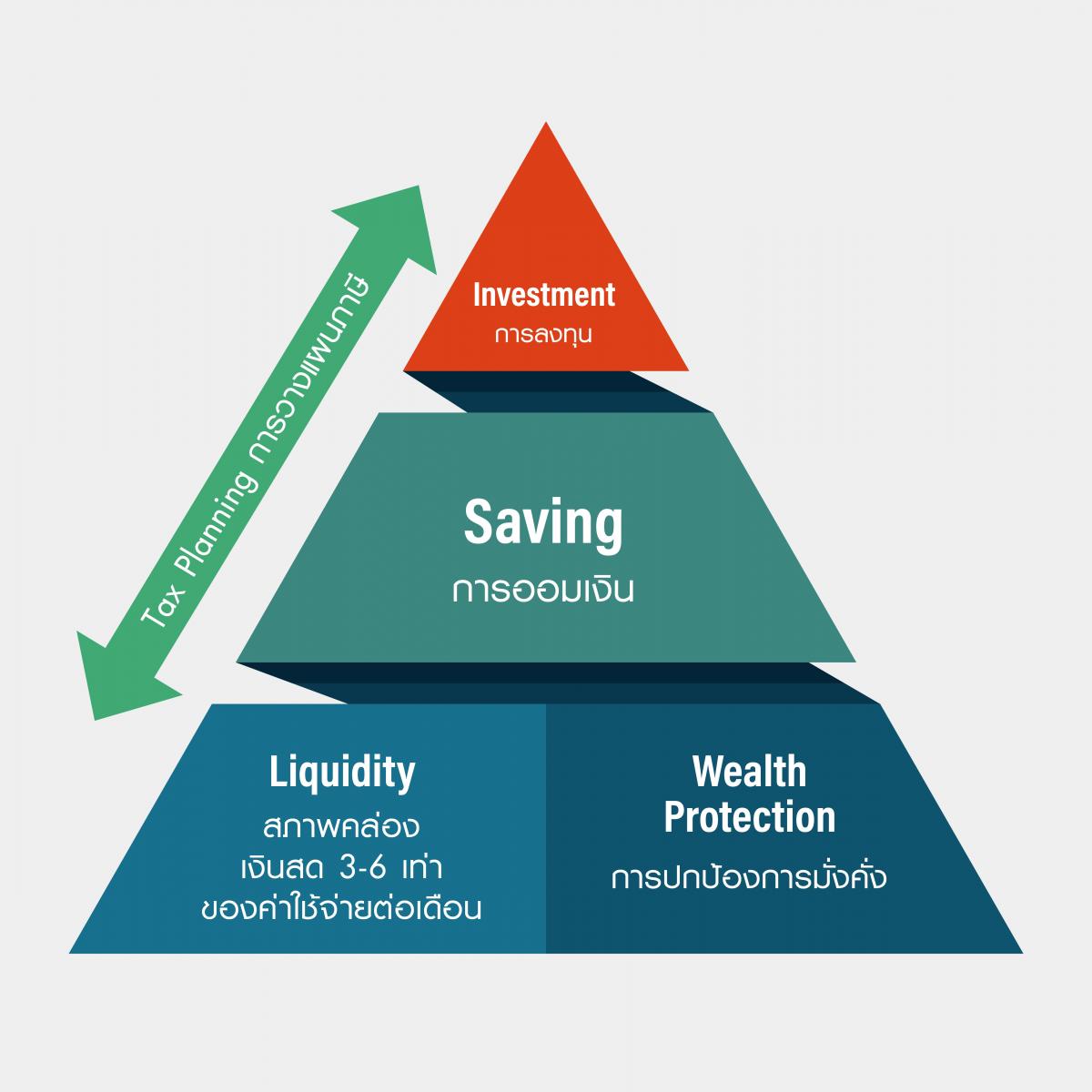

3. Building a Strong Financial Foundation: The Cornerstones of Wealth Enhancement

A solid financial foundation is the bedrock of wealth enhancement. It involves building good financial habits and implementing strategies that ensure your financial security:

- Budgeting: This involves tracking your income and expenses to understand where your money is going and identifying areas where you can save.

- Saving: Putting money aside regularly, even small amounts, allows you to build a financial cushion for emergencies and future goals.

- Investing: Putting your money to work by investing in assets like stocks, bonds, real estate, or businesses can help your money grow over time.

4. Investing: Growing Your Wealth Through Smart Choices

Investing is a powerful tool for wealth enhancement, but it can seem intimidating for beginners. Don’t worry, it’s easier than you think. Here’s a simple approach to get started:

- Start small: Begin with a small amount that you are comfortable investing.

- Diversify: Don’t put all your eggs in one basket. Spread your investments across different asset classes to reduce risk.

- Long-term approach: Wealth enhancement is a marathon, not a sprint. Focus on the long-term growth potential of your investments.

5. Continuously Learn and Grow: Stay Ahead of the Financial Curve

The financial world is constantly evolving. Staying informed about new trends, investment opportunities, and financial strategies is crucial for continuous wealth enhancement.

- Read books and articles: There are countless resources available to help you learn about personal finance.

- Attend workshops and seminars: Gain insights from experts and connect with like-minded individuals.

- Seek professional advice: Consider working with a financial advisor to develop a personalized plan.

6. Embrace a Growth Mindset: The Power of Continuous Learning

Just as your finances grow, so too should your knowledge and skills. A growth mindset embraces challenges as opportunities for learning and improvement. It’s about continuously seeking new knowledge, taking calculated risks, and evolving your financial strategies to stay ahead of the curve.

Embrace Your Journey to Wealth Enhancement

The journey to wealth enhancement is not about reaching a specific financial milestone but about becoming financially empowered. It’s about developing a mindset that values financial responsibility, strategic planning, and continuous growth. By embracing these principles and taking consistent action, you can unlock the secrets to building a brighter financial future.

Secondary Keywords: financial freedom, money management, investment strategies, wealth creation, personal finance